QUEBEC CITY, May 22, 2024 (GLOBE NEWSWIRE) -- Robex Resources Inc. (TSXV: RBX) (“Robex” or the “Company”) is pleased to announce a Mineral Resource Estimate update prepared by Micon International Co Limited (“Micon”) for the Mansounia Central and Mansounia South deposits (collectively, the “Mansounia Deposit”) in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”), (the “Mansounia 2024 MRE Update”).

Highlights of the Mansounia 2024 MRE Update include:

- The total contained gold for the Mansounia Indicated Mineral Resources is reported as 303koz following the conversion of 35% of Inferred Mineral Resources to Indicated Mineral Resources compared to the previously announced Mansounia 2023 MRE update1; and

- The Mansounia 2024 MRE update increases the total in-situ contained gold of the Kiniero Gold Project Indicated Mineral Resources by 23% compared to the previous 2023 Kiniero Gold Project Feasibility Study MRE.

Aurelien Bonneviot, Chief Executive Officer commented: “I am very encouraged by the results of the Mansounia infill drilling program. They have confirmed the geological potential of the 5km mineralisation trend from Sabali North to Mansounia South and our ability to convert Inferred Mineral Resources to Indicated Mineral Resources.”

Mansounia Deposit Indicated Mineral Resources reinforce prospectivity of the Kiniero Project

Following completion of the first phase of infill drilling at the Mansounia Deposit, Robex reports a significant conversion of Inferred Mineral Resources to Indicated Mineral Resources, resulting in an increase of the in-situ Kiniero Gold Project Indicated Mineral Resources. The results are shown in the tables below. The high conversion rate supports the geological interpretation and mineralisation model for the Mansounia Deposit.

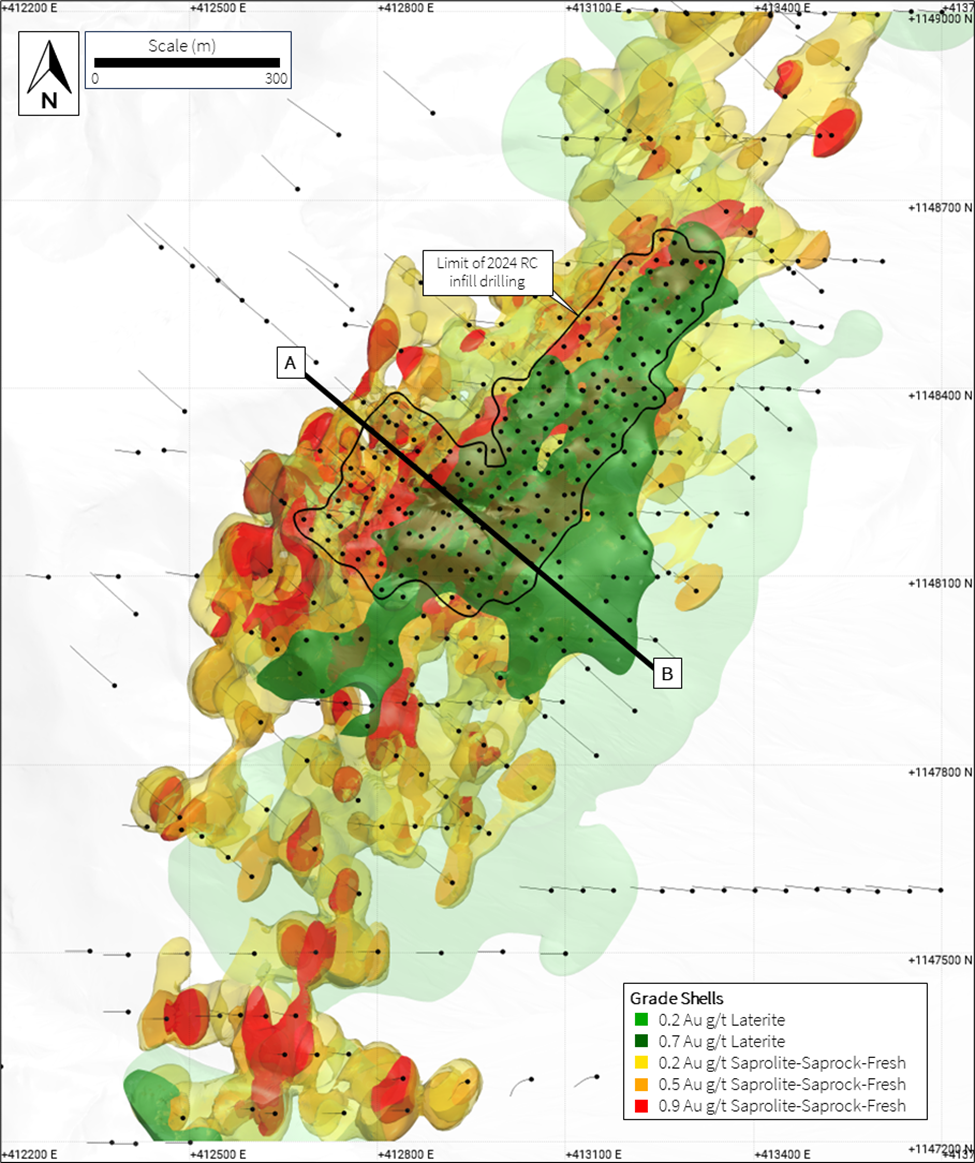

The Mansounia 2024 MRE Update prepared by Micon includes the Mansounia Central and Mansounia South deposits, and has been prepared based on a 126 Reverse Circulation (“RC”) infill drilling program on a 30m-by-30m grid totaling 11,029 meters. A single block kriging drill hole spacing study was used to inform the infill drill grid spacing and Mineral Resource classification.

Table 1: Mineral Resources of the Mansounia Deposit, effective May 16th, 2024

| Pit | Mineral Resource Classification | Tonnage (Mt) | Grade (g/t Au) | Contained Gold (koz) |

| Mansounia | Indicated | 9.4 | 1.00 | 303 |

| Inferred | 19.4 | 0.94 | 589 |

Notes:

- The Mineral Resource Estimate has been prepared in accordance with NI 43-101 and has an effective date of May 16th, 2024.

- To demonstrate Reasonable Prospects for Eventual Economic Extraction (RPEEE), open pit Mineral Resources were constrained by an optimised pit shell. All blocks above the cut-off and within the pit shell were included in the Mineral Resources. Micon created the optimised pit shell.

- Cut-off grades for Mineral Resource reporting were calculated using a gold price of US$ 1,950 oz and are: laterite 0.5 g/t Au; saprolite (oxide) 0.3 g/t Au; saprock (transition) 0.7 g/t Au; and fresh 0.9 g/t Au.

- Mineral Resources are not Mineral Reserves and have not demonstrated economic viability. There is no certainty that all or any part of the estimated Mineral Resources will be converted into Mineral Reserves.

- Average density values used are: laterite 2.12 t/m3; saprolite (oxide) 1.66 t/m3; saprock (transition) 2.46 t/m3; and fresh 2.66 t/m3.

- Grade interpolation by ordinary kriging using a rotated block model (azimuth 40°) with a block size of 12 m (X) by 12 m (Y) by 5 m (Z). Outlier management used grade capping for extreme outliers and a restricted search neighbourhood for outliers on a domain-by-domain basis.

- Mineral Resources in volumes with a drill grid spacing of 30 m by 30 m were classified as Indicated Mineral Resources based on the results of a single block kriging drill hole spacing study updated as part of the Mansounia 2024 MRE Update. All other volumes were classified as Inferred Mineral Resources. To limit extrapolation, a wireframe was used to constrain the interpolated blocks to approximately 10 m below the base of the drilling and 40 m lateral to the drilling.

- Totals presented in this table reported from the Mineral Resource models, are subject to rounding, and may not total exactly.

- The Mansounia license is currently in the process of conversion from exploration to exploitation.

Table 2: Comparison of the Mansounia 2023 MRE and 2024 MRE Updates

| Pit | Mineral Resource Classification | 2023 MRE1 Update | 2024 MRE Update | ||||

| Tonnage (Mt) | Grade (g/t Au) | Contained Gold (koz) | Tonnage (Mt) | Grade (g/t Au) | Contained Gold (koz) | ||

| Mansounia | Indicated | - | - | - | 9.4 | 1.00 | 303 |

| Inferred | 28 | 0.96 | 879 | 19.4 | 0.94 | 589 | |

Notes:

- Micon completed the 2023 MRE update for Mansounia in December 2023. Reported Inferred Mineral Resources differ from December 22nd press release due to updated cut-off grade values being used.

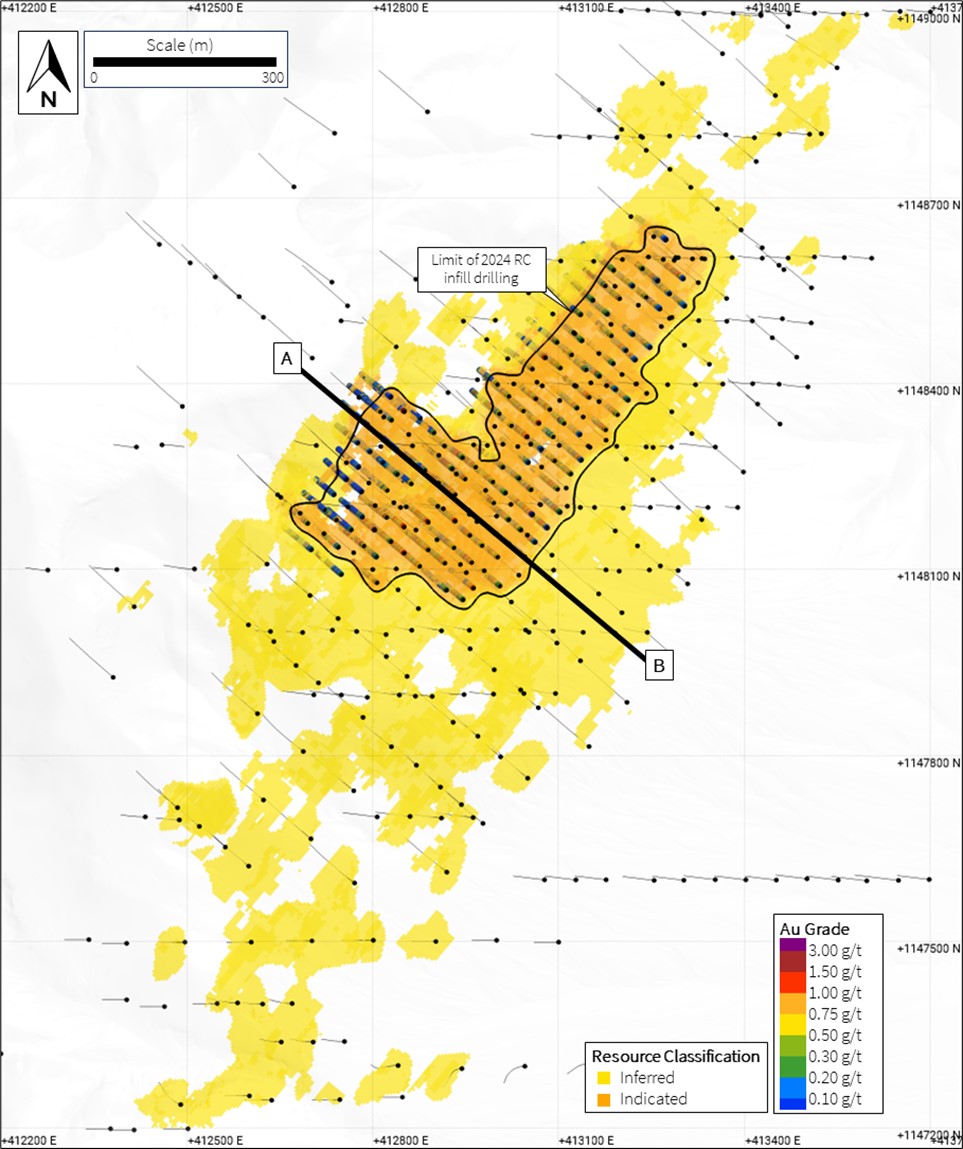

Figure 1. Plan view map of Mansounia shows the completed drilling and modelled grade shell wireframes.

Figure 2. Plan view map of Mansounia showing the completed drilling with assay results for the 2024 infill RC drilling, and the block model coloured by Mineral Resource classification constrained to Mineral Resources within the US$ 1,950 RPEEE pit shell and above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t Au).

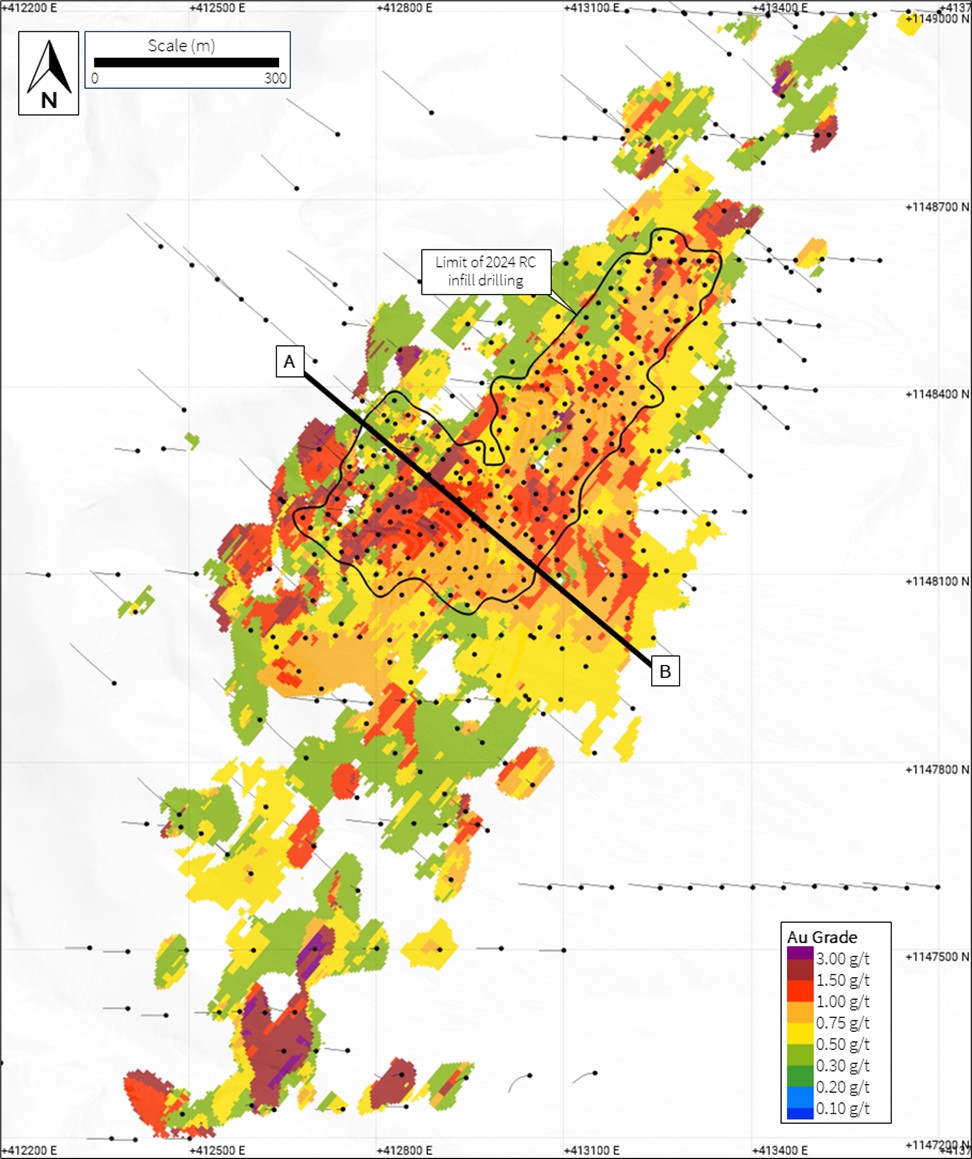

Figure 3. Plan view map of Mansounia showing the block model constrained to Mineral Resources within the US$ 1,950 RPEEE pit shell and above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t Au).

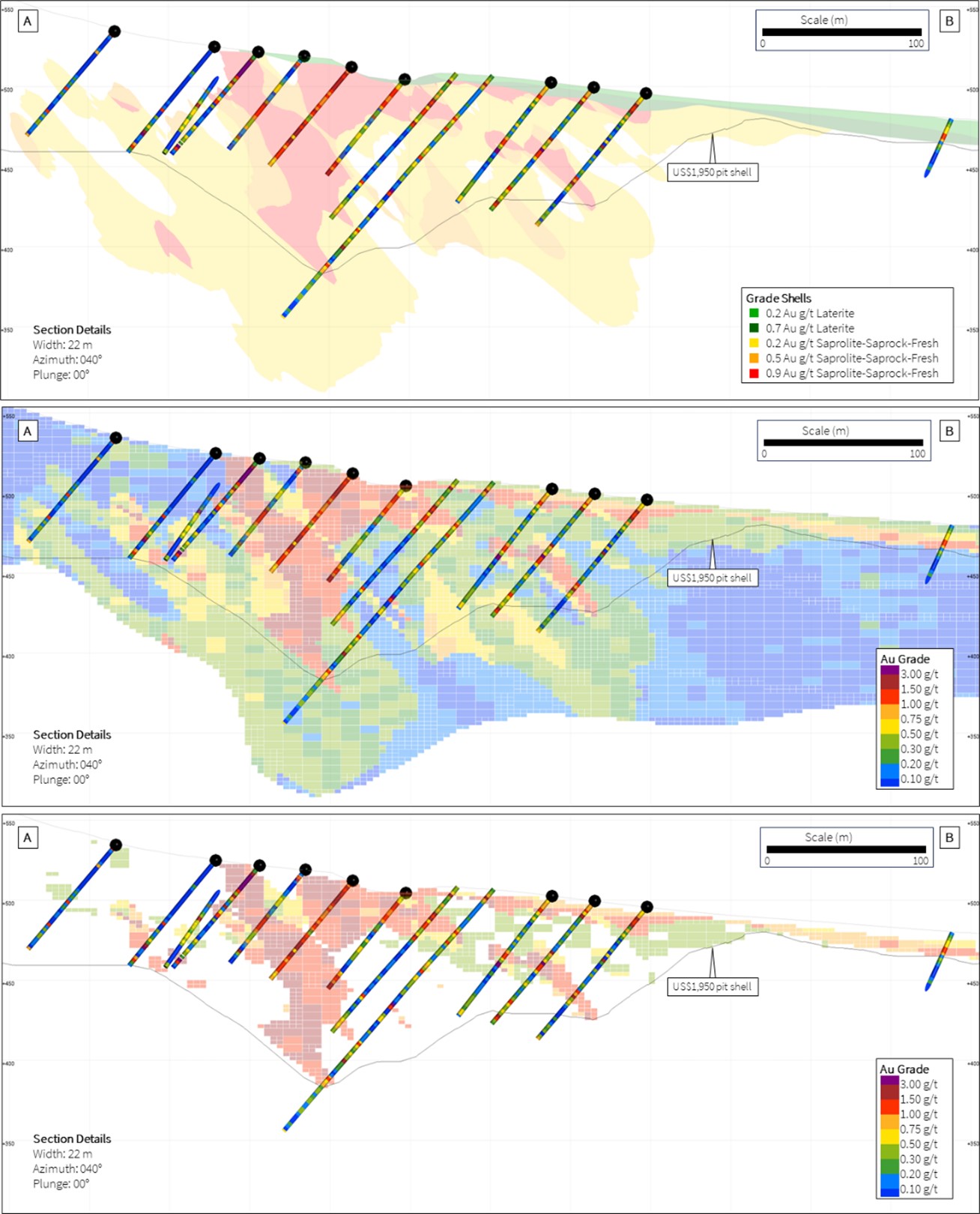

Figure 4. Cross-sections A-B show the (top) modelled grade shell wireframes that remain open at depth; (middle) interpolated block Au grades, to limit extrapolation a volume was used to constrain the interpolated blocks to approximately 10 m below the base of the drilling and 40 m lateral to drilling; (bottom) interpolated block Au grades constrained to Mineral Resources within the US$ 1,950 pit shell and above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t Au). Drill collars coloured black are from the 2024 RC infill drill program.

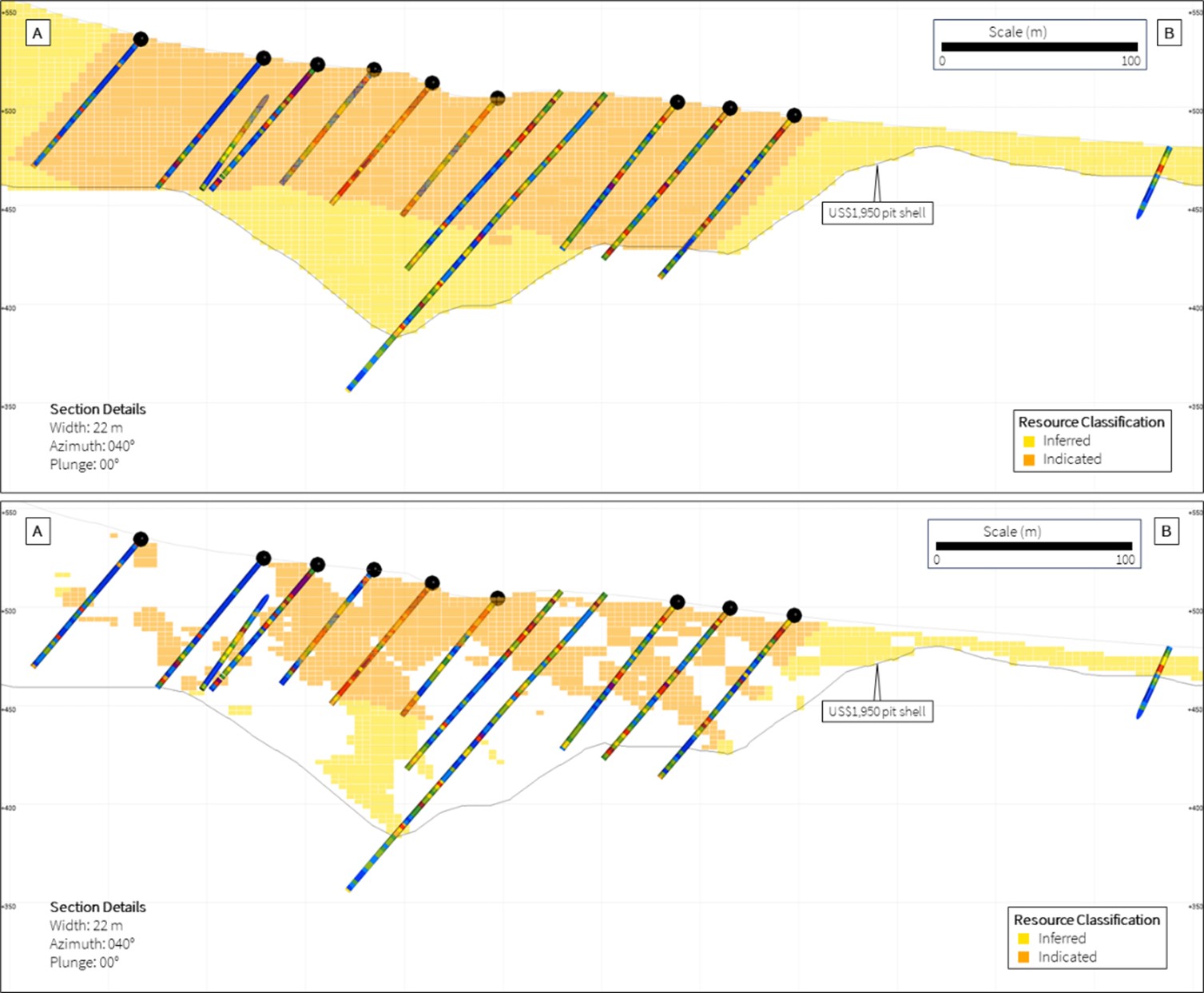

Figure 5. Cross-sections A-B show the (top) resource classification within the US$ 1,950 pit shell; and (bottom) the Mineral Resource classification constrained to Mineral Resources within the US$ 1,950 pit shell and above cut-off (laterite 0.5 g/t Au; saprolite 0.3 g/t Au; saprock 0.7 g/t Au; and fresh 0.9 g/t Au). Drill collars coloured black are from the 2024 RC infill drill program.

Scientific and Technical Information

The information in this announcement which relates to the updated Mineral Resource Estimate is based upon information prepared by or under the supervision of Dr. Ryan Langdon, PhD, MCSM, MEarthSci, CGeol, FGS, who is a Qualified Person as defined by NI 43-101 and a professional registered with the Geological Society of London, and does not or did not have at the relevant time an affiliation with the Company or its subsidiaries, except that of independent consultant/client relationship. Dr. Ryan Langdon is a Senior Mineral Resource Geologist with Micon International Co Limited and has over 12 continuous years of exploration and mining experience in various mineral deposit styles. Dr. Ryan Langdon has reviewed and approved the technical information in this news release. Dr. Langdon has also approved information relating to exploration, drilling and sampling.

In this news release, the terms "mineral resource", "inferred mineral resource", "indicated mineral resource", "mineral reserve", "preliminary economic assessment", "pre-feasibility study" and "feasibility study" have the meanings ascribed to those terms in the Definition Standards on Mineral Resources and Mineral Reserves adopted by the Canadian Institute of Mining Metallurgy and Petroleum (“CIM Definition Standards”) and incorporated into NI 43-101.

About Robex Resources Inc.

Robex is a multi-jurisdictional West African gold production and development company with near-term exploration potential.

The Company is dedicated to safe, diverse and responsible operations in the countries in which it operates with a goal to foster sustainable growth.

Robex has been operating the Nampala Mine in Mali since 2017 and is advancing the long-life low-AISC Kiniero Project in Guinea, which demonstrates a c. 10-year mine life with c. 1Moz of Mineral Reserves.

Robex is supported by two strategic shareholders and has the ambition to become a mid-tier gold producer in West Africa.

For more information

ROBEX RESOURCES INC

Aurélien Bonneviot, Chief Executive Officer

Stanislas Prunier, Investor Relations & Corporate Development

+1 581 741-7421

Email: investor@robexgold.com

www.robexgold.com

FORWARD-LOOKING INFORMATION AND FORWARD-LOOKING STATEMENTS

Certain information set forth in this news release contains “forward‐looking statements” and “forward‐looking information” within the meaning of applicable Canadian securities legislation (referred to herein as “forward‐looking statements”). Forward-looking statements are included to provide information about Management’s current expectations and plans that allows investors and others to have a better understanding of the Company’s business plans and financial performance and condition.

Statements made in this news release that describe the Company’s or Management’s estimates, expectations, forecasts, objectives, predictions, projections of the future or strategies may be “forward-looking statements”, and can be identified by the use of the conditional or forward-looking terminology such as “aim”, “anticipate”, “assume”, “believe”, “can”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “guide”, “indication”, “intend”, “intention”, “likely”, “may”, “might”, “objective”, “opportunity”, “outlook”, “plan”, “potential”, “should”, “strategy”, “target”, “will” or “would” or the negative thereof or other variations thereon. Forward-looking statements also include any other statements that do not refer to historical facts. Such statements may include, but are not limited to, statements regarding: the perceived merit and further potential of the Company’s properties; the Company’s estimate of mineral resources and mineral reserves; capital expenditures and requirements; the Company’s access to financing; preliminary economic assessment and other development study results; exploration results at the Company’s properties; budgets; strategic plans; market price of precious metals; the Company’s ability to successfully advance the Kiniero Gold Project on the basis of the results of the feasibility study with respect thereto, as the same may be updated from time to time, the whole in accordance with the revised timeline previously disclosed by the Company; the potential development and exploitation of the Kiniero Gold Project and the Company’s existing mineral properties and business plan, including the completion of feasibility studies or the making of production decisions in respect thereof; work programs; permitting or other timelines; government regulations and relations; optimization of the Company’s mine plan; the future financial or operating performance of the Company and the Kiniero Gold Project; exploration potential and opportunities at the Company’s existing properties; costs and timing of future exploration and development of new deposits; the Company’s ability to enter into definitive documentation in respect of the USD115 million project finance facility for the Kiniero Gold Project (including a USD15 million cost overrun facility, the “Facilities”), including the Company’s ability to restructure the Taurus USD35 million bridge loan and adjust the mandate to accommodate for the revised timeline of the enlarged project; timing of entering into definitive documentation for the Facilities; and if final documentation is entered into in respect of the Facilities, the drawdown of the proceeds of the Facilities, including the timing thereof.

Forward-looking statements and forward-looking information are made based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such statements or information. There can be no assurance that such statements or information will prove to be accurate. Such statements and information are based on numerous assumptions, including: the ability to execute the Company’s plans relating to the Kiniero Gold Project as set out in the feasibility study with respect thereto, as the same may be updated from time to time, the whole in accordance with the revised timeline previously disclosed by the Company; the Company’s ability to complete its planned exploration and development programs; the absence of adverse conditions at the Kiniero Gold Project; the absence of unforeseen operational delays; the absence of material delays in obtaining necessary permits; the price of gold remaining at levels that render the Kiniero Gold Project profitable; the Company’s ability to continue raising necessary capital to finance its operations; the Company’s ability to restructure the Taurus USD35 million bridge loan and adjust the mandate to accommodate for the revised timeline of the enlarged project; the Company’s ability to enter into definitive documentation for the Facilities on acceptable terms or at all, and to satisfy the conditions precedent to closing and advances thereunder (including satisfaction of remaining customary due diligence and other conditions and approvals); the ability to realize on the mineral resource and mineral reserve estimates; and assumptions regarding present and future business strategies, local and global geopolitical and economic conditions and the environment in which the Company operates and will operate in the future.

Certain important factors could cause the Company’s actual results, performance or achievements to differ materially from those in the forward-looking statements including, but not limited to: geopolitical risks and security challenges associated with its operations in West Africa, including the Company’s inability to assert its rights and the possibility of civil unrest and civil disobedience; fluctuations in the price of gold; limitations as to the Company’s estimates of mineral reserves and mineral resources; the speculative nature of mineral exploration and development; the replacement of the Company’s depleted mineral reserves; the Company’s limited number of projects; the risk that the Kiniero Gold Project will never reach the production stage (including due to a lack of financing); the Company’s capital requirements and access to funding; changes in legislation, regulations and accounting standards to which the Company is subject, including environmental, health and safety standards, and the impact of such legislation, regulations and standards on the Company’s activities; equity interests and royalty payments payable to third parties; price volatility and availability of commodities; instability in the global financial system; the effects of high inflation, such as higher commodity prices; fluctuations in currency exchange rates; the risk of any pending or future litigation against the Company; limitations on transactions between the Company and its foreign subsidiaries; volatility in the market price of the Company’s shares; tax risks, including changes in taxation laws or assessments on the Company; the Company obtaining and maintaining titles to property as well as the permits and licenses required for the Company’s ongoing operations; changes in project parameters and/or economic assessments as plans continue to be refined; the risk that actual costs may exceed estimated costs; geological, mining and exploration technical problems; failure of plant, equipment or processes to operate as anticipated; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; the effects of public health crises, such as the COVID-19 pandemic, on the Company’s activities; the Company’s relations with its employees and other stakeholders, including local governments and communities in the countries in which it operates; the risk of any violations of applicable anticorruption laws, export control regulations, economic sanction programs and related laws by the Company or its agents; the risk that the Company encounters conflicts with small-scale miners; competition with other mining companies; the Company’s dependence on third-party contractors; the Company’s reliance on key executives and highly skilled personnel; the Company’s access to adequate infrastructure; the risks associated with the Company’s potential liabilities regarding its tailings storage facilities; supply chain disruptions; hazards and risks normally associated with mineral exploration and gold mining development and production operations; problems related to weather and climate; the risk of information technology system failures and cybersecurity threats; and the risk that the Company may not be able to insure against all the potential risks associated with its operations.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. These factors are not intended to represent a complete and exhaustive list of the factors that could affect the Company; however, they should be considered carefully. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information.

The Company undertakes no obligation to update forward-looking information if circumstances or Management’s estimates, assumptions or opinions should change, except as required by applicable law. The reader is cautioned not to place undue reliance on forward-looking information. The forward-looking information contained herein is presented for the purpose of assisting investors in understanding the Company’s expected financial and operational performance and results as at and for the periods ended on the dates presented in the Company’s plans and objectives, and may not be appropriate for other purposes.

See also the "Risk Factors" section of the Company's Annual Information Form for the year ended December 31, 2023, available under the Company’s profile on SEDAR+ at www.sedarplus.ca or on the Company's website at www.robexgold.com, for additional information on risk factors that could cause results to differ materially from forward-looking statements. All forward-looking statements contained in this news release are expressly qualified by this cautionary statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

____________________

1 Refer to press release dated December 22nd, 2023.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a9af5ba2-8faf-47f4-9a03-aef13998b29b

https://www.globenewswire.com/NewsRoom/AttachmentNg/f8222743-83c7-4d48-a1d5-c427411fbce9

https://www.globenewswire.com/NewsRoom/AttachmentNg/f2841f92-5837-4119-9fb9-672daae669b8

https://www.globenewswire.com/NewsRoom/AttachmentNg/deed518d-b77c-42fc-be5c-8aafabe2d884

https://www.globenewswire.com/NewsRoom/AttachmentNg/3496410d-aa79-4a46-8a77-24b5396c3772

source: Robex Resources Inc.

【香港好去處】etnet全新頻道盛大推出!全港最齊盛事活動資訊盡在掌握!► 即睇