|

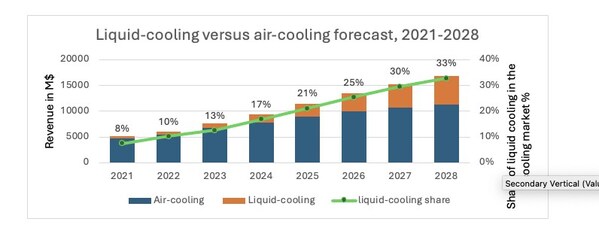

LONDON, June 18, 2024 /PRNewswire/ -- In a groundbreaking development, the data center thermal management market has surged to a staggering $7.67bn, outpacing previous forecasts according to new research from Omdia. This unprecedented growth is poised to continue with a robust CAGR of 18.4% until 2028. This surge will largely be fueled by AI-driven demands and innovations in high-density infrastructure marking a pivotal moment for the industry.

As AI computing becomes ubiquitous, the demand for liquid cooling has surged dramatically. Key trends include the rapid adoption of Rear Door Heat Exchangers (RDHx) combined with 1-P direct-to-chip cooling, achieving an impressive 65% year-over-year growth, frequently integrating heat reuse applications. This period also sees a strategic blend of air and liquid cooling technologies, creating a balanced and efficient thermal management.

Omdia's Principal Analyst, Shen Wang: "In 2023, the global data center cooling market experienced increased consolidation, Top5 and Top10 concentration ratios rising by 5% from the previous year. Omdia expanded vendor coverage in its report to include 49 companies, up from 40, adding Chinese OEMs and direct liquid cooling component suppliers. Vertiv, Johnson Controls, and Stulz retained their top three positions, with Vertiv notably gained 6% market share, due to strong North American demand and cloud partnerships."

Market growth for data center cooling was primarily constrained by production capacity, particularly for components like Cooling Distribution Units (CDUs), rather than a lack of demand. Numerous supply chain players struggled to satisfy the soaring market needs, causing component shortages. However, improvements forecasted for 2024 are expected to alleviate this issue, unlocking orders delayed from the previous year due to supply chain bottlenecks. During this time, liquid cooling adoption witnessed robust growth, particularly in North America and China, with new vendors entering the scene and tracked companies exhibiting significant expansion. In this near $1bn market of liquid cooling, direct-to-chip vendor CoolIT remain the top leader in liquid cooling market, followed by immersion cooling leader Sugon and server vendor Lenovo.

The data center thermal management is advancing due to AI's growing influence and sustainability requirements. Despite strong growth prospects, the industry faces challenges with supply chain constraints in liquid cooling and embracing sustainable practices. Moving forward, the integration of AI-optimized cooling systems, strategic vendor partnerships, and a continued push for energy-efficient and environmentally friendly solutions will shape the industry's evolution. Successfully addressing these challenges will ensure growth and establish thermal management as a cornerstone of sustainable and efficient data center operations, aligning technology with environmental stewardship.

"Data center cooling is projected to be a $16.8bn market by 2028, fueled by digitalization, high power capacity demand, and a shift towards eco-friendly infrastructure, with liquid cooling emerging as the biggest technology in the sector," concludes Wang.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Fasiha Khan Fasiha.khan@omdia.com

source: Omdia

想要獨家投資理財Tips?即Like etnet 全新Facebook專頁► 立即讚好