|

GUANGZHOU, China, June 17, 2024 /PRNewswire/ -- On June 13th, the Science and Technology Innovation Board (STAR Market) celebrated its fifth anniversary since its launch in 2019. Positioned as a platform for serving high-level scientific and technological sufficiency, the STAR Market embraced companies in strategic emerging industries, such as new-generation IT, high-end equipment manufacturing, new materials, energy conservation and environmental protection, new energy and biomedicine, contributing new quality productive forces.

Over the past five years, there are 573 companies listed on the STAR Market, raising over US$125.5 billion through IPOs, with combined market value exceeding US$703 billion, as of June 12th. The quarterly reports revealed that STAR-listed companies achieved a total operating revenue of US$41.2 billion, a year-on-year increase of 4.6%, and 67% of companies have delivered achieved positive revenue growth in the first quarter of 2024.

Meanwhile, the index system of STAR Market has progressively improved. Since the first STAR Market index, the SSE STAR 50 Index, was launched in 2020, there are more than 15 indices tracking the performance of the STAR Market, the collective AuMs of relevant products amounting to US$22 billion. Moreover, products such as E Fund STAR 50 ETF (Code: 588080) were included in ETF Connect Program, empowering foreign investors who seek exposure to innovation-driven tech companies.

Leading asset managers have actively participated in providing diverse investment tools for investors. Notably, E Fund Management ("E Fund"), the largest asset manager in China, continued to enrich its ETF line-up, which included E Fund STAR 50 ETF, E Fund STAR 100 ETF (Code: 588210), and E Fund STAR Growth ETF (Code: 588020).

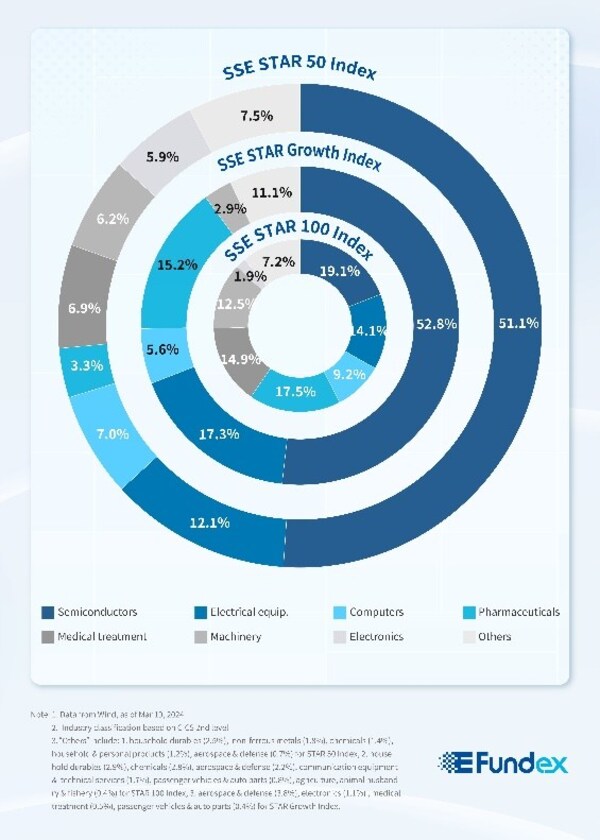

While the SSE STAR 50 Index is comprised of 50 largest companies, with an average market cap of US$6.4 billion, the SSE STAR Growth Index highlights the growth potential of its constituents and selects 50 stocks with higher growth rates of operating revenue and net profit.

The SSE STAR 100 Index consists of 100 mid-sized stocks, excluding constituents of STAR 50 Index. Unlike SSE STAR 50 Index and SSE STAR Growth Index, which are concentrated in semiconductor sector, the SSE STAR 100 Index is broadly diversified across industries and the weights of the top 5 industries - semiconductors, pharmaceuticals, medical treatment, electrical equipment, and machinery – are quite close, accounting for nearly 80% in total.

About E Fund

Established in 2001, E Fund Management Co., Ltd. ("E Fund") is a leading comprehensive fund manager in China with close to RMB 3.2 trillion (USD 450 billion) under management.* E Fund's clients include both individuals and institutions, ranging from central banks, sovereign wealth funds, social security funds, pension funds, insurance and reinsurance companies, to corporates and banks. Long-term oriented, it has been focusing on the investment management business since inception and believes in the power of in-depth research and time in investing.

source: E Fund Management

【與拍賣官看藝術】畢加索的市場潛能有多強?亞洲收藏家如何從新角度鑑賞?► 即睇