|

New Zeki Data Report Breaks Down Competition Within the Deep-Tech Ecosystem

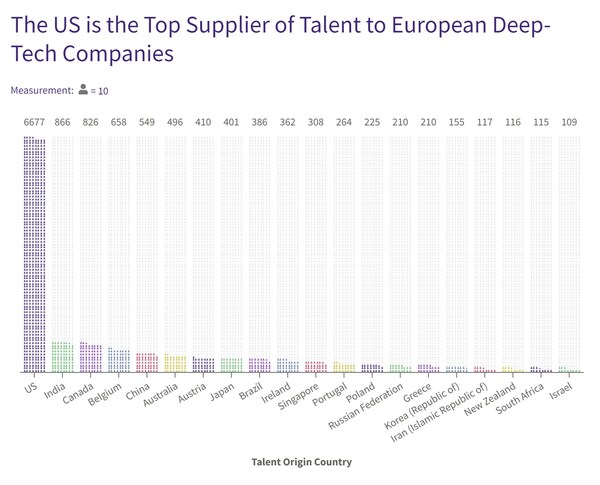

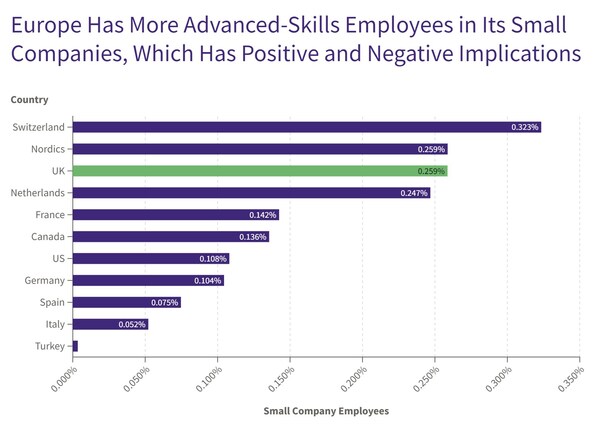

LONDON, Sept. 24, 2024 /PRNewswire/ -- A new global report on deep-tech talent published by Zeki Data today reveals the US generates three times as many deep-tech companies as the UK, while small European startups have a much higher concentration of advanced-skilled talent than in North America.

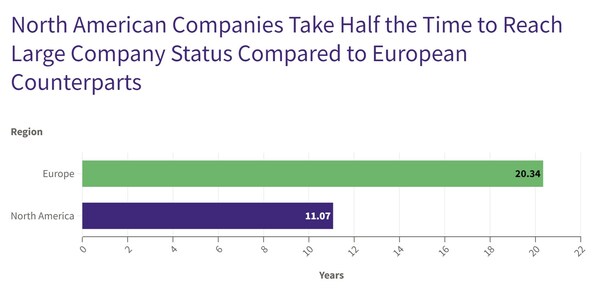

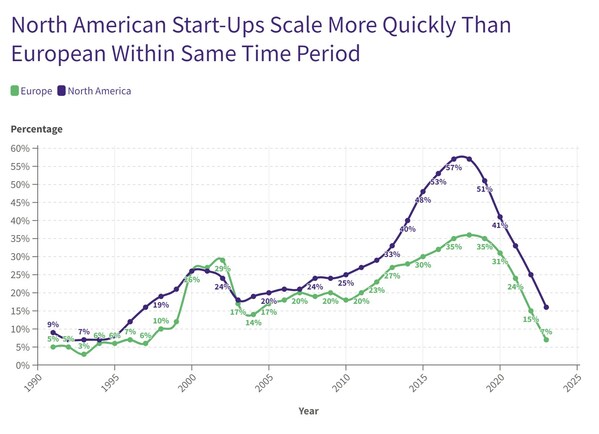

North American Startups Scale 2x Faster than European: Deep-tech startups in the United States are scaling twice as fast as European counterparts.

The Deep-Tech Talent War: Europe vs. North America Showdown 2024 Report unravels the underlying trends in deep-tech between Europe and North America using talent as the lens. The report shows the dramatic slowing of new deep-tech companies since 2020.

Zeki Data, a UK-based deep-tech data company that scores the future potential of deep-tech companies to guide investment and talent acquisition, reveals in the report that countries are waking up to the need to attract and retain talent as a key to building sovereign capabilities in transformational technologies that will underpin the next phase of national prosperity and security.

"There is intense competition for the finite science and engineering talent that deep-tech companies need to advance their innovation ambitions," said Tom Hurd, Zeki Data CEO and Co-Founder. "Governments are throwing money at deep-tech start-ups to secure an innovative advantage, but Zeki's data shows there's limited ROI amid countervailing winds of high capital costs and market consolidation."

"Attracting and retaining the most innovative talent is the best indicator of future innovation potential for deep-tech companies," Hurd added. "This should be the priority for countries and companies alike."

The Deep Tech Talent War report focuses on the less studied evolution of the 6,100+ most important European and North American deep-tech companies and the strategic implications of their race to master new technologies. Zeki looked at the 8,795,902 people that the companies employ globally, particularly the 227,948 individuals with highly advanced skills.

KEY ZEKI DATA REPORT FINDINGS

1. Government Investment Fails to Spur Startup Growth: New deep-tech company formation has slowed dramatically since 2020 in Europe and North America. Countries have made major financial investments to drive a greater pace of deep-tech innovation to no end. Countervailing winds of high capital costs and market consolidation have dampened the effect of government industrial policies.

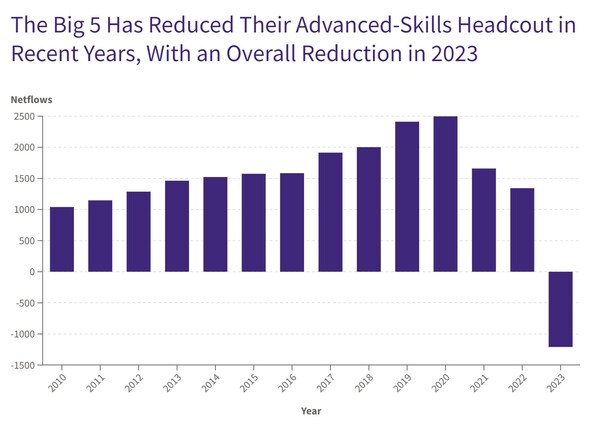

2. Magnificent 7 Prioritize Low-Cost Hires: Market consolidation driven by GenAI is driving dramatic hiring shifts across Amazon, Apple, Google, Meta, Microsoft, Nvidia, and Tesla. Deep-tech companies are favoring early-career, lower cost hires, and cutting higher-cost experience.

3. American Startups Scale 2x Faster than European: Deep-tech startups in the United States are scaling twice as fast as European counterparts.

4. Engineering Biology Companies Struggle to Scale: Engineering biology companies remain attractive acquisition targets as they struggle to grow to medium and large-sized businesses.

5. Battery Technology has Imploded: Preceded by a green energy talent exodus that began in 2019, renewable energy has fallen out of favor with talent as demonstrated by hires rapidly exiting the sector since 2022.

6. Software Engineering is All the Rage: Semiconductor, aerospace, and defence companies are battling it out for top software engineering talent, while much of the cybersecurity sector appears to be prioritizing sales over software talent.

7. Chinese Talent Exits the West: At the country-level, the exodus of Chinese deep tech talent from Western companies is accelerating. China has firmly established itself as the destination of choice for Chinese talent leaving European and North American deep-tech companies.

The full report is available for free download at zekidata.com/talentwar

About Zeki Data

Zeki Data is a UK-based deep-tech data company that scores the future potential of deep-tech companies to guide investment and talent acquisition. Zeki's data includes over ten million leading scientists, engineers, and researchers specialising in cutting-edge fields such as AI, quantum computing, data engineering, semiconductors, and health technology. Organisations leverage Zeki data to optimise their talent acquisition processes and innovation pipelines—and unlock new, quantitative insights about the quality, momentum and future direction of innovation at individual companies.

We've developed 20 bespoke indicators to assess each expert, detailing their areas of expertise and evaluating their professional impact, technical proficiency, career trajectory, ambition, reputation, and future potential. Our client base spans investors, corporate strategists, HR teams, and government bodies, all leveraging Zeki insights to stay ahead in the evolving tech landscape.

Learn more at www.zekidata.com

New company formation since 2000 has been the same in North America and Europe. However, when we look at the annual growth rates of hiring advanced-skilled, deep-tech talent, North American companies have scaled much faster than their European equivalents.

Historically, deep-tech companies have been the main destination for global talent with advanced skills. However, this is not the case in recent years, with a dramatic drop in numbers joining deep-tech companies in the past two years.

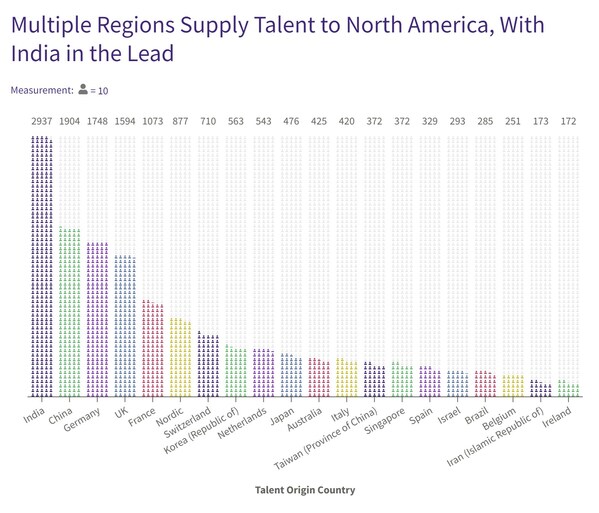

North American companies can attract European nationals, especially those specialising in AI, although this has tailed off in recent years. However, the main alternative source of talent for North American companies is India, and to a secondary extent, China, and wider Asian countries.

Europe shows a much higher percentage of small companies and attract up to three times more of the productive pool of advanced-skills, deep-tech talent in their country of origin than in the US. However, this is a mixed blessing as European governments increasingly execute industrial policies to promote deep-tech at home, they run the risk of creating 'zombie start-ups': employing finite, hard-to-find human resources while increasing relying on government support.

This shift to hiring early-career talent reserves a trend across the Magnificent Seven going back to 2014. It is also a general trend across deep-tech as companies, for different reasons, seek to make the most efficient use of free cash flow as they face new challenges after the COVID-19 pandemic, be they technical or financial.

source: Zeki

樂本健【年度感謝祭】維柏健及natural Factors全線2件7折► 了解詳情